HyGOAT insights

India's Hydrogen Dilemma: Reflections from IIT Delhi's National Conference

Ekansh Sharma

Founder, HyGOAT | Hydrogen Certification Specialist

IIT Delhi's National Conference on Green Hydrogen — one theme dominated every panel: India's hydrogen demand problem.

We can build production capacity. We can subsidize Electrolyzers. But who's going to buy green hydrogen at ₹250-560/kg when grey costs ₹175-220/kg?

That question and the collision between domestic energy security and export premiums defined the conference.

The Moment That Surprised Me

During the first panel, an NGHM policy advisor was explaining India's incentive structures. I asked:

"H2Global's Asia lot is open for bids right now — €1.18 billion for RFNBO-compliant green hydrogen imports. Indian projects are eligible, but bankability depends on demonstrating compliance pathways BEFORE construction. If India wants to compete for this funding, should our incentive schemes prioritize pre-Certification services and global standards alignment, or do we accept that early export projects will face higher compliance costs than domestic ones?"

His response? He wasn't familiar with H2Global's offtake mechanism. Neither were several other panelists.

This wasn't isolated. Throughout the day, I realized: Many Indian hydrogen stakeholders including policy advisors; don't yet understand the EU RFNBO market architecture. But I do ask myself, why should they?

Decarbonization Reality Check

The best session of the day was Session 2 on industrial decarbonization, moderated by Gaurav Verma (MLK Destar).

Gaurav didn't soft-pedal the complexity: Green hydrogen is ONE decarbonization pathway, not THE pathway.

-

CCUS (carbon capture) works for existing infrastructure.

-

Biogenic pathways (biomass, biogas) leverage waste streams.

-

Electrification solves some use cases directly.

Different industries, different solutions. The obsession with hydrogen as a silver bullet misses the nuance.

His question stuck with me: "Are we chasing hydrogen because it's the right solution, or because it's the fashionable one?"

The debate sharpened: Mandates or incentives?

NGHM's current approach is production-side subsidies (₹50/kg → ₹30/kg over 3 years). But without demand-side mandates, who absorbs the ₹75-340/kg price gap? The taxpayer? Government? Private sector?

One panelist noted bluntly: "India is a compliance-driven market. Adoption happens when it's enforced, not when it's encouraged."

But enforcement creates a cost burden problem. All three (taxpayer, government, industry) are interconnected.

Push the cost onto industry → competitiveness suffers.

Subsidize fully → fiscal sustainability breaks.

The trade-off is brutal.

The Offtake Crisis

Every session circled back to the same bottleneck: supply is racing ahead of demand.

Shri Sushant Dey (IREDA) put numbers to it: IREDA finances 70% of project costs, but requires collateral, unless you have guaranteed offtake. Precedents exist (Kusum solar, ethanol blending mandates). But green hydrogen? No domestic demand certainty = collateral required = MSMEs blocked from financing.

The Domestic vs. Export Dilemma

The final session asked the strategic question India keeps avoiding: Domestic demand first, or export focus first?

Here's where geography and regulation collide:

RFNBO ≠ GHCI

These aren't apples-to-apples. Lifecycle boundaries differ. RFNBO compliance gets you GHCI automatically, but GHCI compliance doesn't guarantee RFNBO. If you're targeting EU markets, you build to RFNBO. If you're domestic-only, GHCI suffices.

Geographic Strategy

-

Coastal regions = export advantage (proximity to shipping, EU markets pay premium)

-

Landlocked high-solar areas = domestic hubs (Rajasthan, Gujarat inland)

But here's the contradiction: India wants both energy independence AND export revenue. You can't prioritize both simultaneously with limited capital.

The response? The oxygen mask analogy came up:

"Put your own oxygen mask on before helping others."

Secure India's energy independence (domestic H2) before chasing export premiums.

My Take: India Needs to Decide

We're trying to do everything at once:

-

Subsidize production (SIGHT incentives)

-

Build domestic offtake (ambiguous mandates)

-

Compete in export markets (RFNBO compliance costs)

-

Maintain fiscal discipline (limited subsidy runway)

Something has to give.

Option 1: Domestic-first (Oxygen mask approach)

Mandate blending/offtake for fertilizer, refineries, steel. Accept higher costs short-term. Build domestic demand certainty → unlock IREDA financing → scale drives cost reduction.

Option 2: Export-led (Premium pricing approach)

Focus coastal projects on RFNBO compliance. Target H2Global, EU contracts. Use export revenue to subsidize domestic rollout later. Shed risk aversion, deploy capital on bankable export projects.

Option 3: Hybrid (current approach)

Continue trying both. Risk: Neither demand pathway reaches critical mass. 94% project attrition persists.

What I'm Betting On!

Coastal RFNBO projects will move first. Why?

-

EU offtake certainty (H2Global €1.18bn India-addressable lots, March 2026)

-

IREDA collateral waivers (export contracts = guaranteed offtake)

-

Premium pricing (EU pays more than domestic grey hydrogen parity)

Domestic mandates will follow, once export-led projects prove the model works and costs drop.

Go Where the Demand Is

There's a simpler frame for all of this: go where the demand already exists.

Domestic demand for Indian green hydrogen is still conditional. It depends on mandates getting passed, offtake agreements getting signed, price gaps getting bridged. All of that is real work in progress — but it's future work.

H2Global is different. It's €2.94 billion of committed European procurement money, structured, tendered, and open for bids right now. This isn't speculative demand waiting for policy. It's institutional buyers with capital allocation, looking for RFNBO-compliant supply from exactly the geographies Indian coastal projects sit in.

When demand is certain and supply is uncertain, the rational move is to position your supply where the demand already is. Not where you hope it will be.

Why the P2X Clock Starts Now

The deeper reason to act early isn't just the March 19 deadline — it's the P2X development cycle.

Green ammonia, green methanol, sustainable aviation fuel (SAF) — the derivatives H2Global actually procures — take 4 to 7 years to move from concept to commercial delivery. That means if you want to be a delivering supplier in the 2029-2031 window (when the second and third rounds of H2Global are live), you need to start the bankability and compliance work now.

The H2Global assessment isn't just about winning a bid. It's about starting the development clock. Getting the RFNBO compliance score, identifying your gaps, generating the documentation your future Conformity Body will ask for — that's 6 to 12 months of work if you don't know what you're doing. Compressed into hours if you do.

Early movers in P2X who get their compliance architecture right in 2026 will have a structural cost advantage over everyone who starts in 2027. Certifiers will be overwhelmed. CBs will have queues. Standards will tighten further. The window to build first-mover compliance infrastructure is now.

If you're an Indian producer exploring H2Global eligibility, the first step is understanding exactly where you stand against the RFNBO threshold — before you engage lawyers, consultants, or Conformity Bodies. That's what the H2 Global Assessment Tool is built for.

But I could be wrong. That's the beauty (and terror) of being early.

Perhaps it's our misfortune (or fortune in disguise) that we've chosen RFNBO compliance as our north star. We're solving a problem that most of the ecosystem doesn't even know exists yet.

But the March 2026 H2Global Asia Lot deadline is real. €2.94 billion is real. And Indian projects that understand RFNBO pathways before everyone else catches up? That's not just a competitive advantage — it's the only viable entry point into a market that rewards preparation over enthusiasm.

Conference Details

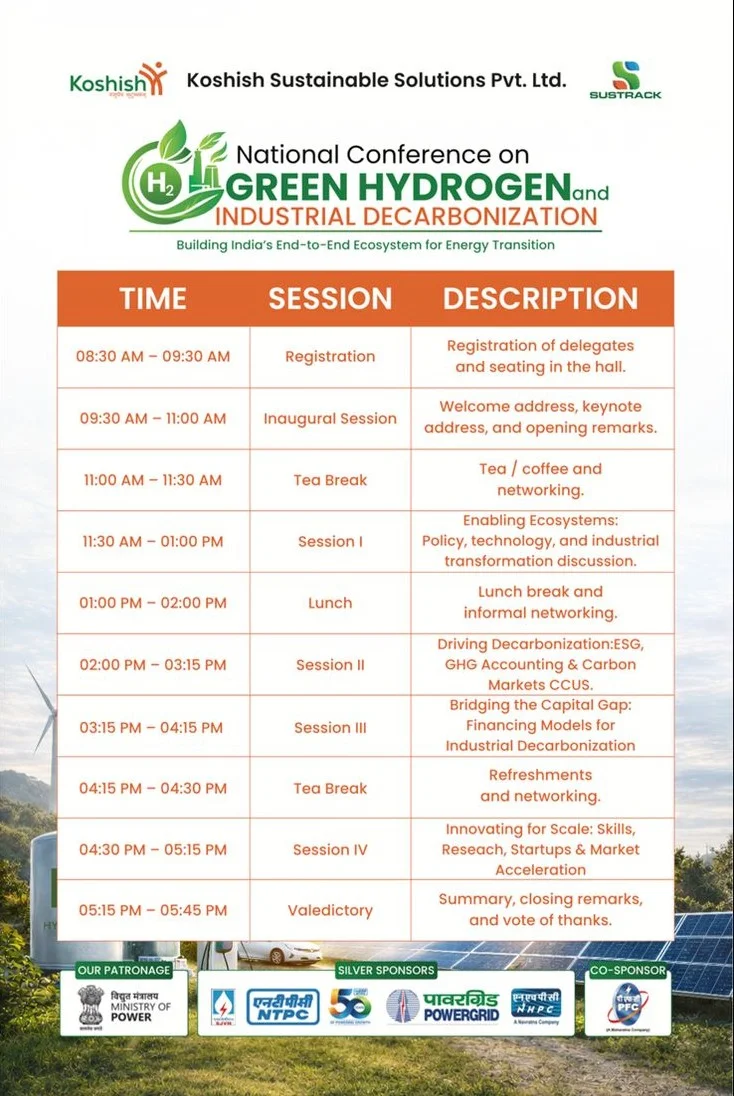

Event: National Conference on Green Hydrogen & Industrial Decarbonization Date: February 10, 2026 Location: R&I Park Auditorium, IIT Delhi, New Delhi Organizers: Koshish Sustainable Solutions + SUSTRACK

Gratitude

Thanks to Koshish Sustainable Solutions Pvt. Ltd. and SUSTRACK for organizing.