HyGOAT insights

India's First Green Hydrogen R&D Conference: Field Notes

Ekansh Sharma

Entrepreneur | Engineer | Hydrogen Tracer

I joined researchers, policy-makers, and operators for India's first Green Hydrogen R&D Conference, hosted by MNRE and CEEW on 11--12 September 2025. These notes capture the signals I heard -- what is working, where friction remains, and what it means for founders building in the space.

In this article, I am reviewing India's green hydrogen landscape as presented at the conference, highlighting consensus on progress and unresolved challenges, and sharing a founder's perspective.

The Road So Far

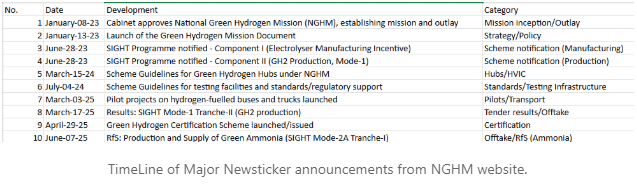

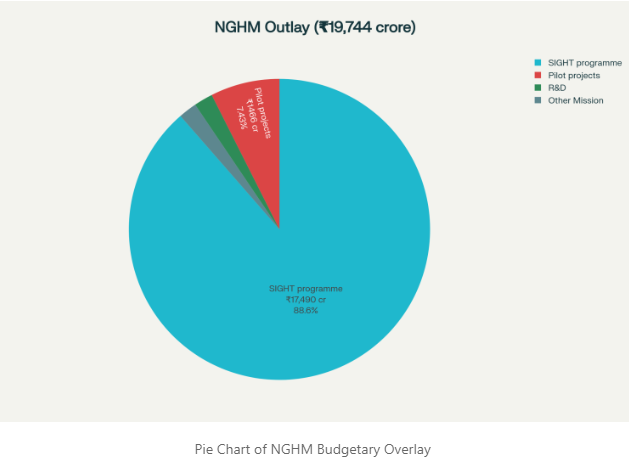

The National Green Hydrogen Mission has moved from vision to execution. Government now steers policy design, pilots regulatory frameworks, and invests in foundational infrastructure; market participants finally have a shared map.

- SIGHT production and electrolyser incentives: INR 17,490 crore (88.6 percent)

- Pilot projects: INR 1,466 crore (7.4 percent)

- R&D programs: INR 400 crore (2.0 percent)

- Certification, hubs, skilling, portal/PMU, and outreach: INR 388 crore (2.0 percent)

Green Flags -- What Is Working

- Government as demand anchor. Structured offtake guarantees and government-as-first-buyer policies de-risk early deployments in steel, fertilisers, SAF, and other priority sectors.

- Cost leadership is real. SECI auctions clearing at INR 49.75 per kg show the production cost curve bending toward the USD 2 per kg ambition, accelerating investor confidence and project pipelines.

- Industry-led scale-up. National test centres (1--5 MW), lifecycle-cost benchmarks, and pilot validation infrastructure bridge the TRL gap for alkaline, PEM, and AEM electrolysers.

- Indigenous value chains. CSIR's 30 kW PEM stack and parallel pilots in catalysts, membranes, coatings, and biohydrogen reduce import dependence and diversify technology pathways.

- Diversified deployment vectors. Progress in compressed hydrogen storage (Type IV at 350 bar, nascent 500--700 bar), LOHC experiments, and predictive safety analytics future-proof logistics options.

- Product-market fit emerges. Fuel cells replacing diesel gensets (a USD 1--1.5 billion market) and storage applications show pragmatic demand, aided by policy levers and local feedstocks.

- Demonstration pilots deliver proof. Hydrogen bus depots, cookstoves, and drone projects recycle lessons from the CNG rollout and shrink the valley of death.

- Translational research culture. IIT Madras and peers are building modular, open-access test beds, aligning academic output with industry needs.

- Safety advances. IOCL's hydrogen bus pilots, wearable leak sensors, and IoT dashboards strengthen safety practices and export readiness.

- Biomass pathways count. Biological hydrogen now features in certification schemes, with coordinated support (land, crop mapping, logistics) de-risking decentralised pilots.

- Consortia and open IP pools. Industry-academia-CSIR collaborations around indigenisation and shared test beds shrink technology cycles.

- Talent pipeline momentum. Mission-mode pilots and skill programs create placement-ready engineers for electrolyser manufacturing, storage, and safety ops.

Red Flags -- Where We Are Stuck

- R&D deployment disconnect. Without linking marquee projects to homegrown pilots, India risks importing turnkey plants and missing crucial cost-learning cycles.

- Component and safety gaps. Domestic manufacturing of stacks, cylinders, and safety hardware lags; without rapid qualification, costs could stay above USD 2 per kg.

- Infrastructure bottlenecks. National-scale test and accreditation facilities are thin, and grant disbursal remains slow -- especially painful for startups.

- Under-funded mid-TRL work. Too much money still goes to blue-sky research; TRL 4--7 scale-up lacks synchronised funding.

- Standards vulnerability. Hydrogen-specific codes and local testing are nascent, while carbon-fibre supply and cracking/LOHC tech face integration hurdles.

- Systemic valleys of death. Procurement delays, fragmented financing, and certification backlogs stretch commercialisation timelines.

- Industrial integration hurdles. Retrofitting fertiliser and petrochemical infrastructure must solve renewable intermittency, reactor flexibility, and strict safety envelopes.

- Testing deficits. Most labs rely on international benchmarks; indigenous equipment shortages stall certification and export credibility.

- Regulatory fragmentation. Disjointed mandates, patchy safety deployments, and inconsistent digital compliance erode investor trust.

- Biological pathway uncertainty. Process control, purification, and logistics challenges keep costs high without targeted R&D.

- Deep-tech talent and capital gaps. Skilled engineers, collaborative consortia, and scale-stage funding are still scarce.

- Trust and co-investment shortfalls. Predictable public-private funding, faster certifications, and hydrogen-aware incubators remain unmet needs.

A Founder Takeaway

Panel after panel wrestled with a single question: how do we allow engineers and founders to experiment, fail fast, and return stronger? Deep-tech funding cycles are slow, TRL 5--7 pilots are hard to finance, and grants can take 12--18 months to land -- time a startup simply does not have.

To hit 5 MMTPA by 2030 we have to move from "Make in India" to "Innovate in India." That mindset shift demands bold, ecosystem-level investment and relentless bureaucracy reduction.

The quote that stayed with me came from Achintya Venkat during the session on fuel-cell frontiers:

For startups, two things are critical: time and money. Government funding takes too long -- our MNRE grant has been stuck for 18 months -- and cheque sizes rarely cover pilot production. We need faster disbursal, 30--50 crore co-investments, and grant processes that do not bog founders down in virtual-account paperwork.

HyGOAT exists for this precise reason -- to shrink the compliance schlep so innovators can focus on building resilient green hydrogen products.

If you want to continue the conversation, connect with me or explore how HyGOAT can support your certification and MRV workflows.