HyGOAT insights

Why ACME Cleantech Dominated India's Green Ammonia Auctions

Ekansh Sharma

Entrepreneur | Engineer | Hydrogen Tracer

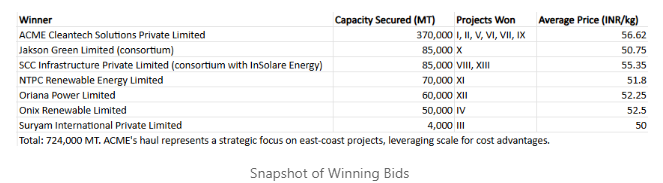

ACME Cleantech walked away with six of the thirteen SECI auctions under the SIGHT Mode-2A tranche, beating well-capitalised peers on price and credibility. The wins were not a lucky break -- they were the result of a carefully planned proximity play, operating depth, and a willingness to underwrite short-haul logistics.

Snapshot of Winning Bids

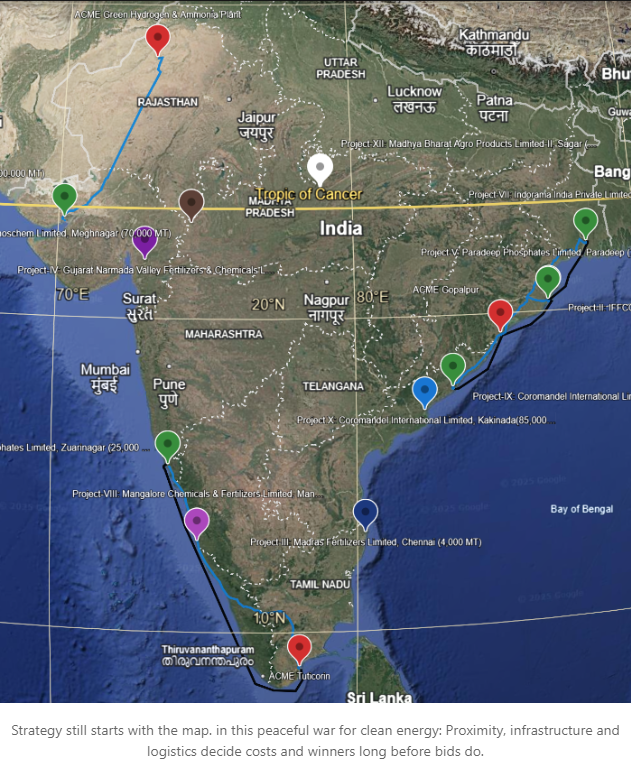

Strategy Still Starts With the Map

ACME placed its most aggressive bids where molecules could move along short coastal or rail corridors from Gopalpur (Odisha) to Paradeep, Visakhapatnam, Kakinada, and Haldia. Overland support from Bikaner (Rajasthan) provides redundancy for western deliveries such as Kandla.

"Strategy still starts with the map. In this peaceful war for clean energy, proximity, infrastructure, and logistics decide costs and winners long before bids do."

- Proximity converts to margin. Delivery distances of roughly 200--500 km compress transport costs and keep projects inside existing port and SEZ infrastructure.

- Execution experience. The commissioned green ammonia plant at Bikaner adds bankability and makes aggressive bids believable to evaluators and financiers.

- Portfolio optionality. Coastal siting plus multi-point deliveries create flexibility for future exports as RFNBO-grade demand materialises.

India's Cost Edge

Indian e-reverse auctions cleared at INR 49--56 per kilogram for coastal sites -- well below the delivered-into-EU prices seen in H2Global tenders (about EUR 1,000 per metric ton). Three structural factors explain the gap:

- Domestic delivery basis. No transcontinental freight or EU compliance cost is embedded.

- SIGHT incentives. Mode-2A offers INR 18.82 per kg in year one, stepping down over three years, cushioning early plant economics.

- SEZ infrastructure and renewable resource quality. Port access, common utilities, and high-capacity-factor renewables shave both capital and operating expense.

What ACME Did Right

- Bid discipline backed by data. ACME entered auctions with low opening bids (for example, INR 69.97 per kg at Project-II) and pushed harder in e-reverse rounds, dropping to INR 49.75 where logistics supported it.

- Scale and vertical integration. Shared utilities in Tata Steel SEZ, long-term renewable hedges, and experience in ammonia operations lowered unit costs relative to competitors.

- Risk appetite matched with contracts. Forward hedges and offtake commitments -- including export intent -- gave ACME confidence to underwrite aggressive pricing.

Certification Is the Next Bottleneck

Winning domestically is step one. To unlock export premiums, producers must provide audit-ready chain-of-custody documentation that satisfies EU RFNBO, CertifHy, and other schemes. That means traceability from renewable electron to shipped molecule, marine transport evidence, and defensible emissions accounting.

Where HyGOAT Fits

HyGOAT exists to remove the compliance schlep:

- Digital guarantees of origin that interoperate with GHCI, CertifHy, and emerging standards.

- Automated evidence packs that package data for auditors and carbon-border mechanisms.

- Ledger-backed traceability so every exported tonne retains its premium value.

Takeaways for the Ecosystem

- Developers: Prioritise port-linked SEZs, secure storage and jetty access early, and bid in portfolios rather than single projects.

- Offtakers: Partner on dedicated logistics, upgrade storage for larger parcels, and explore pricing structures that enable supplier hedging without jeopardising domestic supply.

- Policy-makers: Keep tender schedules predictable, expand SEZ-style infrastructure, and maintain transparent incentive roadmaps that crowd in capital.

Quick Reference

- SECI auction sheets (Kandla, Paradeep, Visakhapatnam, Kakinada, Zuarinagar, Haldia)

- Ammonia Energy Association recap of proximity advantages

- H2Global and Fertiglobe disclosures on delivered EU pricing

- MNRE SIGHT Mode-2A incentive schedule

- PV Magazine India and EQ Mag coverage of the Gopalpur complex

- ACME corporate updates on the Bikaner green ammonia facility